Key takeout

-

Capital One Venture X Rewards Credit Card The grant allowed an impressive number of perks, including Airport Lounge Access (until February 1, 2026), eligible spending, return protection, and foreign transaction fee compensation.

-

The Capital One Venture X Card Holder allows you to add up to four certified users to this card at no additional cost.

-

Adding authorized users will allow you to share the card with your family and loved ones, but make sure that additional users are using it responsibly.

Adding authorized users to your credit card offers many benefits. As a cardholder, it allows you to share your card with family and loved ones, and doing so will help boost their credit score. Additionally, you can establish a credit history for authorized users so that everyone’s spending can contribute to the reward.

Capital One Venture X Rewards Credit Card There is an impressive number of benefits for approved users, making it an attractive option for cards with multiple users. Additionally, you can add up to four certified users to this card at no additional cost.

What does the Capital One Venture X Rewards credit card offer?

-

Reward rate:

- 1 trip booked in the capital with 10 miles per dollar with hotels and car rentals

- 5 miles per dollar for flights and vacation rentals booked on a single trip

- 2 miles per purchase every day

-

Welcome offer:

- Spend $4,000 on purchases in the first three months of opening an account and earn 75,000 miles on a trip, worth $750

- Annual fee: $395

In addition to these rewards, Venture X Cards offer attractive benefits for travelers. The card offers up to $300 a year of statement credits for purchases made through Capital One Travel, plus access to Capital One Lounges and over 1,700 preferred pass selection lounges.

Additionally, cardholders receive application credits of up to $120 every four years to cover Global Entry or TSA Precheck membership. Plus, you can earn 10,000 miles each year on your account’s anniversary. There is no limit to the number of rewards you can earn.

What are the benefits of expanding to certified users?

Airport Lounge Access is a major advantage of Venture X, and it’s a perk that doesn’t always extend to certified users. Until February 1, 2026, authorized users will have access to both the Capital One Lounge and the Priority Pass Lounge, allowing two guests to visit. The primary cardholder can then maintain lounge access, paying an annual lounge access fee of $125 per authorized user. Guests will be charged extra depending on the lounge and guest age.

Other Venture X benefits, and whether authorized users will qualify for those benefits, include:

| Benefits of Capital One Venture X | Are authorized users eligible? |

|---|---|

| Reward | Yes, all miles you earn will be pooled into your primary card holder account. |

| Welcome bonus | No, only major cardholders can earn a welcome bonus, but certified user spending contributes to the minimum spending requirements. |

| Selected lounge access to one capital lounge and over 1,300 priority passes | Yes, certified users will be able to enjoy access to Capital 1 Lounge and Priority Pass Lounge until February 1, 2026. |

| Up to $120 credit to cover Global Entry or TSA PreCheck Application Fee (every 4 years) | No, this credit will only be extended to the cardholder. |

| $300 annual statement credit for purchases made through Capital1 trip | No, only the primary cardholders receive credits, but purchases from certified users can count towards it. |

| 10,000 miles per account anniversary | No, only major cardholders can redeem the annual bonus. |

| Returns protection | Yes, authorized users will receive the same purchase protection as the primary cardholder. |

| There are no foreign transaction fees | Yes, major cardholders and certified users will not enjoy foreign transaction fees. |

| Free Hertz President’s Circle® Status* | Yes, both major cardholders and certified users receive free Hertz President’s Circle® status. This offers guaranteed upgrades, the ability to skip lines at specific locations, and a wider selection of cars. |

How much does it cost to add approved users to Capital One Venture X?

You can add up to 4 certified users at no additional charge. This is a competitive offer, taking into account that many cards charge fees to add authorized users. for example, American Express Platinum Card Charge $195 to add additional users.

Starting February 1, 2026, if you want to access the lounge, you will need to pay an additional $125 for each authorized user. If not, adding the allowed items will remain free.

How to add approved users to Capital One Venture x

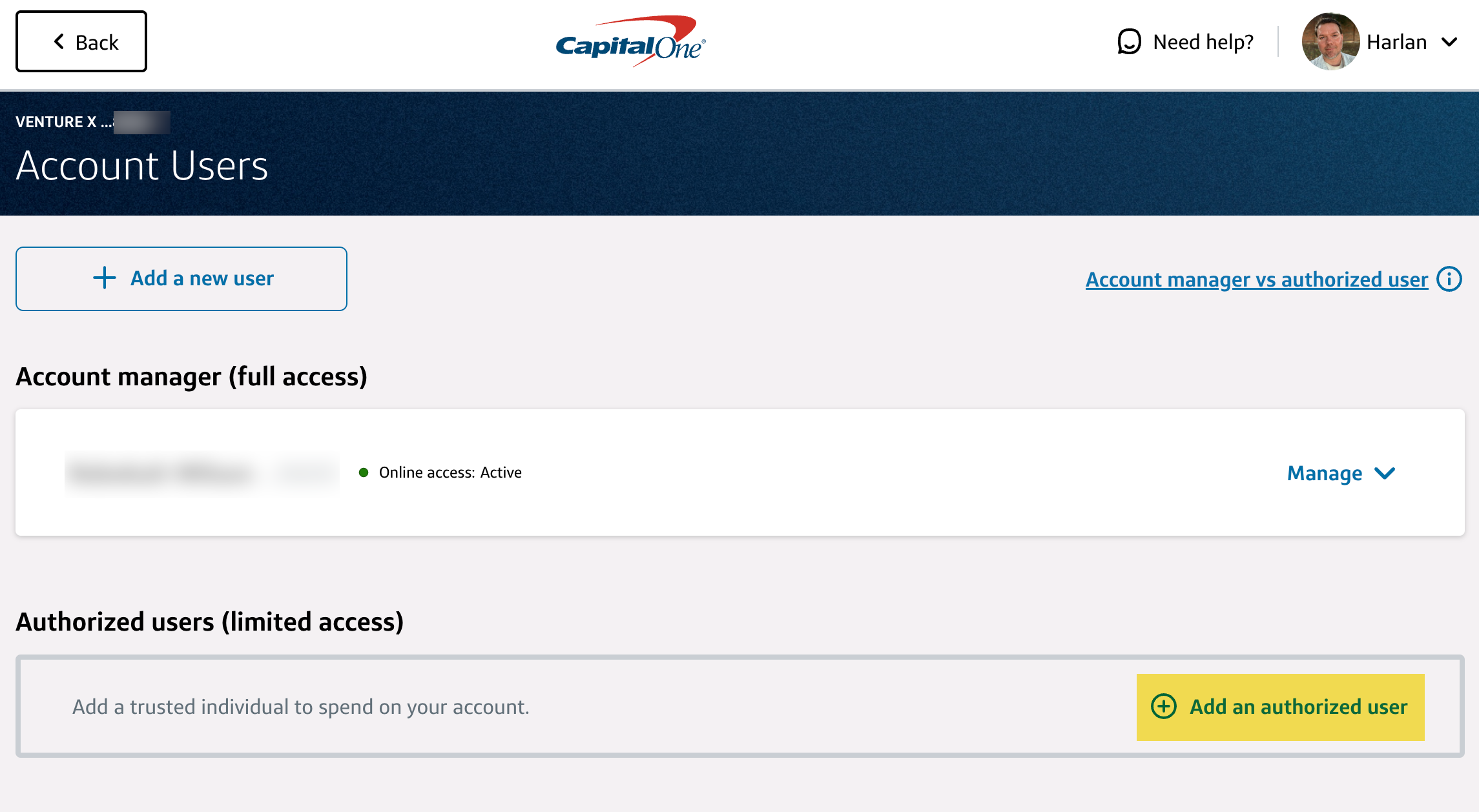

Once your account is approved, you can easily add approved users to your credit card. This can be done via an online account or by calling the number on the back of the card. Primary Card Holders and Account Managers can add certified users to the card.

To get started, log in to your online account.

From there, click “I Want” next to the gear icon. On the screen that appears pop-up, select “Control Cards” and “Manage Account Users.”

On the next screen, click (Add Certified User).

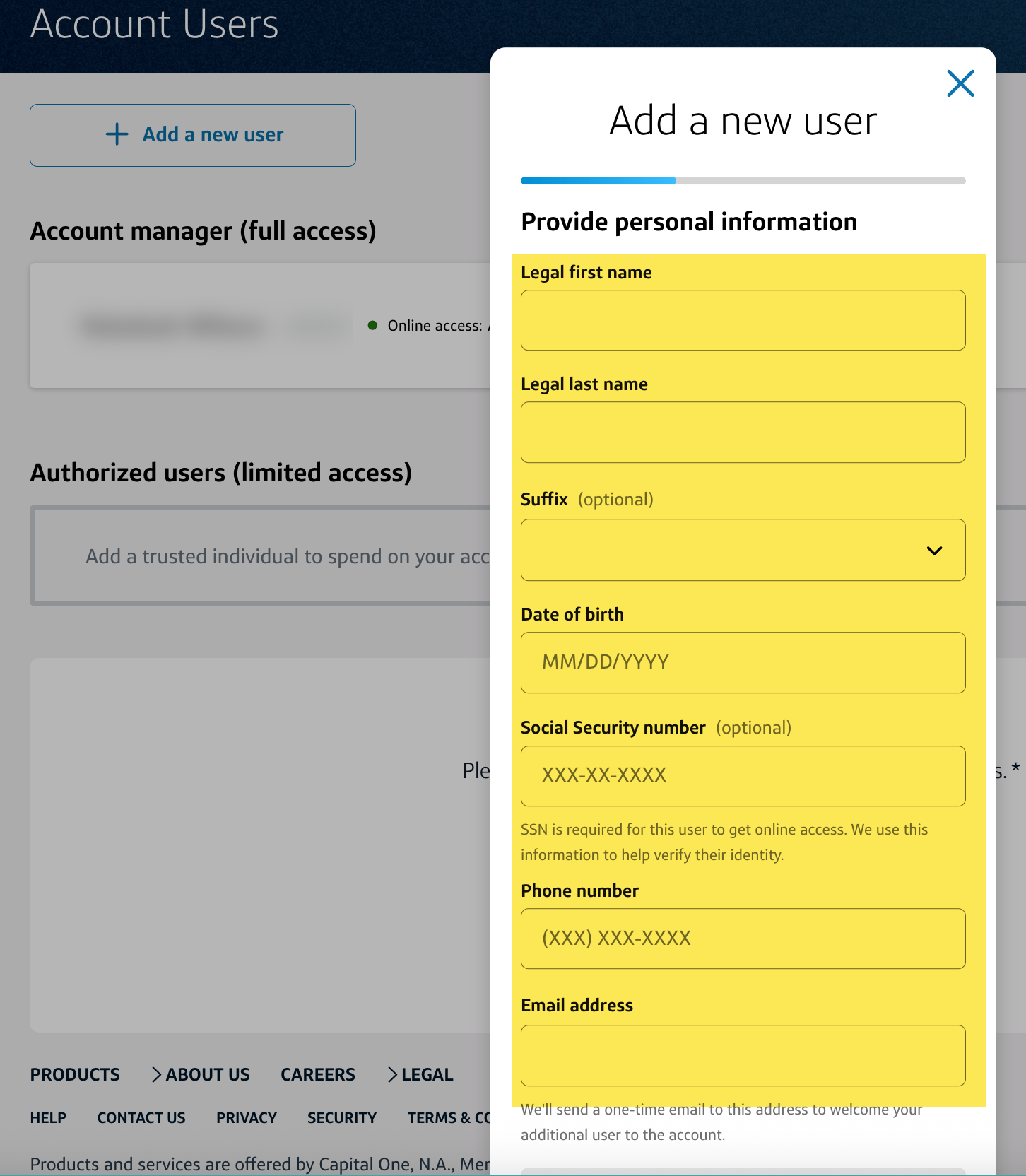

Next, add requested information about the authorized user, such as the full legal name, date of birth, social security number, and contact information. Click (Continue) and follow the prompts. You will need to receive your new certified user card in about a week.

Is it a good idea to add authorized users to Capital One Venture x?

Adding certified users is valuable to both cardholders and authorized users. It’s a great way for families to get rewards together, especially considering that certified users are not subject to the same credit score requirements as cardholders. Additionally, becoming an approved user can help teens and young people establish their credit history. This could be a stepping stone to opening your first credit card.

However, there are certain precautions to be aware of. Capital One reports credit history to the credit department, including the activities of approved users. If an authorized user does not use the card responsibly, it could negatively affect the credits of the cardholder.

Additionally, multiple people on the card can lead to misconceptions about who is due to pay the balance and how much money each cardholder can pay. At the end of the day, negative behaviors affect the credit score of the cardholder.

Conclusion

The Capital One Venture X credit card offers benefits to certified users that other top travel cards are difficult to compete with. As a cardholder, you can earn more miles for each dollar you spend.

Furthermore, the ability to add up to four certified users at no additional cost, not to mention the ability of users with the authority to enjoy airport lounge access by February 1, 2016, makes this credit card particularly attractive to families and groups.

*Eligible cardholders will remain at the upgraded status level until December 31, 2025 upon registration that is accessible through one Capital website or mobile app. Register for the usual Hertz Gold Plus Rewards registration process (such as Hertz.com) (such as Hertz.com). Additional terms apply.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or MasterCard® and may vary depending on the product. Terminology and exclusions apply, so please refer to the guide to each benefit for more information.