Image Source: Getty Images

After spending our whole life at work, we all want to enjoy kickbacks and enjoy the fruits of our labor. But exactly how much passive income do we need to live comfortably? This can vary widely from person to person.

But what is clear is that the amount of money needed for retirement living has steadily risen over time. That means that making the right financial decisions is becoming increasingly important when planning your future life.

The good news is that investors today have more opportunities than ever to achieve their retirement goals. Here’s how you can be confident in achieving a gorgeous retirement:

target

As I mentioned, the exact amount you will need in your later life will depend on factors such as your retirement goal, where you live, and the circumstances of your relationship.

However, it is worth considering what the Pension and Lifetime Savings Association (PLSA) needs to do to a comfortable retirement that the average person needs.

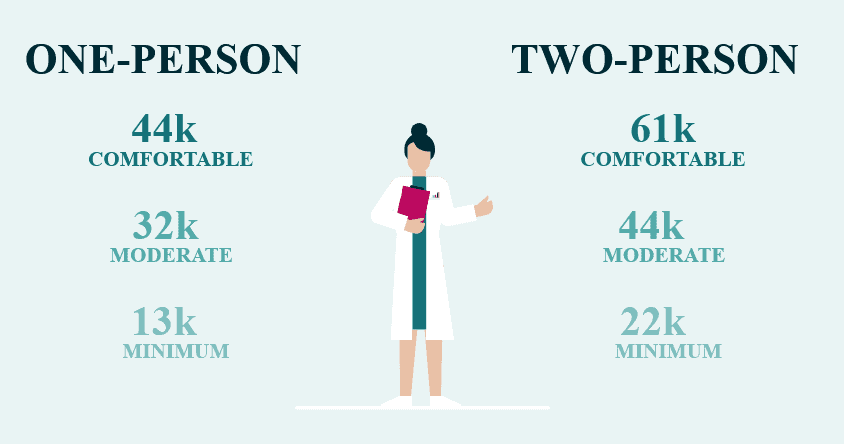

That latest study shows that an average single household needs an income of £43,900 a year for a comfortable lifestyle. This level of income provides essentials and extras, including a healthy budget for food and clothing, a car exchanged every three years, and a two-week holiday for travelling frequently every year.

The figure for two households is £60,600.

£38K+ income

There are many paths an individual can take to achieve that goal. For example, you can invest in your property, develop side hustles, and spend money on stocks that generate dividends and capital gains.

I personally chose to prioritize investments in global stocks to earn retirement benefits. It is also placed aside in cash accounts to manage risk. With a split of 80-20 across these lines, we target average annual revenue of at least 9% of stock investments and 4% of cash over the period.

Let me show you how this works. By investing £400 a month in stocks and cash, you could have had a nest egg of £641,362 to retire if everything goes to the plan.

If you then invest this in 6% historic dividend stock, your annual passive income is £38,482. It was added to the state pension (currently £11,975), so it was easy to achieve what you need to retire comfortably.

Take the US route

Of course, investing in stocks is more risky than putting all your money into a simple savings account. However, such funds and trust iShares Core S&P 500 UCITS ETF (LSE:CSPX) can significantly reduce my risk while targeting the strong long-term returns that the US stock market can offer.

However, remember that its performance can be bumpy during the wider stock market slump.

This Exchange-Traded Fund (ETF) has held in all businesses listed in S&P 500 index. Not only does it provide excellent diversification by sector and region, it also gives you access to world-class companies with market-leading positions and strong balance sheets ( nvidia and apple).

Since 2015, the iShares fund has provided an average annual return rate of 12.5%. If this continues, regular investments here could lead me onto the course for a healthy passive income at retirement. That’s why I already hold it in my portfolio.