Are you wondering if Boldin is the right tool to help you plan your retirement? This Boldin review breaks down everything you need to know. Financial planning can be confusing and even scarier. So I was excited to try out Boldin (formerly known as New Retirement). If you’re someone who wants to know if you’re there…

Are you wondering if Boldin is the right tool to help you plan your retirement? this Boldin Review Decompose everything you need to know.

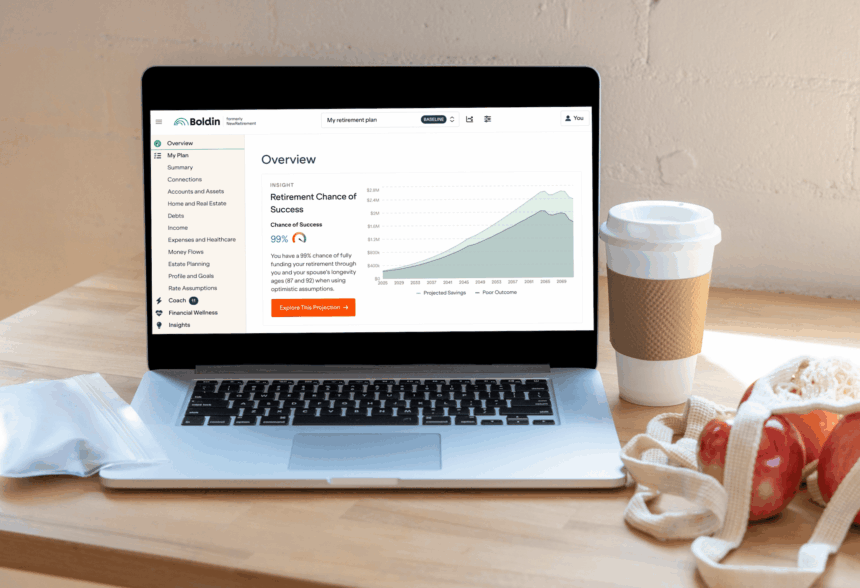

Financial planning can be confusing and even scarier. So I was excited to try out Boldin (formerly known as New Retirement). If you’re on the right track, when you can retire, and how to make money as long as possible, this tool is useful.

Boldin is different from other financial tools as he gets deep into his retirement plans. It’s not just about showing net worth or spending. This will help you make smart, long-term decisions about social security, taxes, healthcare, real estate planning and more.

If you want to take financial planning in your own hands, I think it’s a great financial tool used by Boldin. Run scenarios to make better decisions and get more control over your money. You can get a full financial assessment, including savings rates, investments and more, and create a financial plan that suits you.

Personally, I ended up spending a few hours on the platform simply testing different scenarios, tweaking the information I entered, and digging into the details. It was fun to see that small changes can make a huge difference to my retirement plan and I found it to be extremely helpful in visualizing everything clearly.

Click here to try Boldin for free.

Boldin Review

In this Boldin review we’ll explain to you what it is, how it works, who it works, and for who it is worth the cost.

What is Boldin?

Boldin is retirement planning software that helps you create detailed financial plans. It was originally released as New Retirement, and in 2025 its name was changed to Boldin.

Boldin allows you to model your entire financial journey. This includes savings, expenses, investments, taxes, social security, housing decisions, retirement, and more.

It can help you answer questions such as:

- Are you saving enough?

- Do I need to save or pay off my debt?

- How many houses can I buy?

- When can I retire?

- Can I retire early?

- Will you run out of money?

- Do I need to convert it to Loss?

- Can I afford to help my kids or give them to charities?

It is built for everyday people who want to better understand money and make wise choices, with or without a financial advisor.

I decided to test Boldin because I wanted to find something that is easy to use, helpful and affordable for readers. When I heard that Boldin could build his own financial plan without hiring an advisor, I knew I needed to give it a try.

What stood out to me was how detailed Boldin is. It’s not just about entering a few numbers. You can actually build a complete financial roadmap, test different life decisions and see how they will affect your future.

It’s like having a powerful retirement calculator, a financial coach, and a tax planner all in one.

Are you ready to see what your retirement plan looks like? Click here to create a free Boldin account. It will take just a few minutes to get started.

What does Boldin help you do?

Boldin is about retirement plans and is more than just tracking your investments.

Here are some of the things you can do with Boldin:

- Take a clear picture of your net worth

- Estimate your retirement benefits and costs

- Optimize the optimal age to assert social security

- Learn about loss conversion and tax planning

- Model different housing decisions, such as downsizing and moving

- See how different investment returns will affect your plans

- Planning healthcare and long-term care costs

- Predict real estate values and legacy goals (how much money is it that you want to leave your child?)

- Run a detailed “what-if” scenario

Whether you’re wondering when you’re leaving, whether you can travel more, or whether it’s safe to spend a little extra, Boldin can help you find the answer.

What I like about Boldin is that it’s extremely easy to use. You can spend 10 minutes entering information into the platform and calculator, or spend hours running different scenarios.

Who is Boldin?

Boldin is great:

- People planning to retire

- Those interested in tax, social security or healthcare optimization

- Early retirements and followers of the fire movement

- DIY Money Managers who want to avoid high consultation costs

Real people use the platform.

- Decide whether to retire now

- Model the impact of buying a second home

- Find the best time to assert social security

- Planning medical expenses during early retirement

People say Boldin helps to feel at peace, give him more confidence and avoid costly mistakes.

How does Boldin work?

Boldin is a tool that helps you build your own personalized retirement plan. Create a free account in minutes and start adding information instantly.

To get started with Boldin, here are some things you have to do:

- Sign up for a free account on the Boldin website.

- Enter your personal financial information, including income, assets, savings, retirement goals, and expenses. You can enter it simply by entering it or simply by entering it (there are over 100 data points that can be entered if necessary).

- Use planning tools to build and customize your retirement plans. This includes adding life events such as house reduction, early retirement, and loss conversion.

- Explore the dashboard to view projections, compare what-if scenarios and make it clear if your plans are on track.

One of my favorites about Boldin is how detailed and flexible it is.

You can go as deep as you want, and you don’t even need to link your account if you want to enter things manually. Perfect for people who plan their own retirement and are confident in their future.

Boldin’s best tools

After using the tool myself, here is the feature I think is worth it:

1. Comparison of what-if scenarios

Would you like to know what happens if you retire at 40 instead of 65? What if you get Social Security a few years earlier? Or move to another state?

You can create and compare different versions of your plans. Plus, every time you run a scenario or change your plan, you’ll get instant feedback from Boldin.

I think this will help you make decisions and understand your options.

2. Roth Conversion Explorer

This feature (part of PlannerPlus – paid options) helps you explore when and how long you want to convert from your tax deferred account to a Roth IRA. It looks at your tax and income forecast.

You can test different start/stop years, amounts and see the impact over time. This is one of the most advanced loss conversion tools I’ve seen.

3. Recommendations for improvement methods

Boldin sends alerts to help you retire faster and manage your money better.

For example, you can get an alert saying, “If you pay an additional $250 per month based on your data, you may be able to repay your mortgage before you leave.”

These little practical tips are extremely helpful!

4. Classes and live events

Boldin PlannerPlus users can participate in live sessions to ask questions and learn directly from Boldin experts. This is a great way to get support and see how others use the tool.

For example, some of the classes and events I’m currently watching have multiple live events each week, and some classes that you can access at any time):

- Raising financially savvy children

- Discuss finances with your partner

- Buy or rent a home

- 15 or 30 year mortgage

- HSA Account Fundamentals

- Tax Planning

- Retirement Income Plan

- Real Estate Planning

5. Real-time monitoring of individual financial situations

Boldin allows you to take a quick snapshot of where you are standing and what you need to do.

Yes, you can see your net worth, and you can also create a “watchlist” – I really, really love it. This is probably one of my most favourite features on Boldin.

For example, you can see you:

- Savings rate

- Resignation Savings Prediction

- Cash flow

- Earliest possible retirement date

- Resignation countdown

- Total debt ratio

more. There are about 25 different metrics you can see.

What do you think is your financial success? With Boldin, you can build your own financial plan and learn how to better.

How much does Boldin cost?

Boldin offers both free plans and paid plans called Plannerplus.

- Free plan – Access basic dashboards, some calculators, and simple projections. This plan is great if you’re just starting out and want a quick overview of your retirement photos. You’ll be familiar with the platform and be able to explore your finances without spending money.

- plannerplus – This plan costs $10 a month or $120 a year and comes with a 14-day free trial. With PlannerPlus you can get everything with a free plan. Additionally, all premium tools are available, including loss conversion tools, tax strategies, detailed budget and income planning, live classes, Monte Carlo analysis (testing plans against risk), real-time net asset analysis, a complete library of classes, weekly live events, and the option to link accounts for real-time updates. PlannerPlus is perfect for those who like to implement a variety of scenarios, optimize their tax strategies, and plan healthcare and long-term care costs. The upgrade is definitely worth it.

Which plan do you need?

- If you want a basic overview of where you stand, stick to the free plan.

- If you need detailed insights, powerful tools, and ongoing support, or prepare for retirement (or live) then use PlannerPlus.

Personally, I think both plans will have many great features. I’ve tested both the free plan and the PlannerPlus plan (I personally have PlannerPlus now).

Bordin’s pros and cons

This is what I think is the pros and cons of Boldin:

Strong Points:

- Easy to use financial planning tool

- Useful visual charts and graphs

- Affordable pricing and even free plans

- There is no need to link your account

- Super personalized goal-based

Cons:

- If you want to add all the information, it may seem overwhelming at first. But I think it’s pretty easy to add everything!

- There is no mobile app. For me, I don’t mind about this, but if you want to use it on your mobile phone you will need to log in via an internet browser instead.

FAQ

Below are the answers to some general questions about Boldin.

Is Boldin Planner Plus worth it?

Yes, I think Boldin’s PlannerPlus is worth it if you’re serious about planning your retirement. While the free version is a great place to get started, PlannerPlus has access to more powerful features that actually make a difference, such as tax strategy modeling, loss conversion tools, real estate planning, and detailed What-IF scenarios.

For example, scenarios such as different budgets (pre-retirement, early retirement, late retirement, etc.), loss transformation of the model can be modeled to model relocation of major residences (you can see that downsizing or relocating to other states can affect retirement).

Other benefits of Planner Plus include customizing assumptions such as inflation and property valuation, changing or adding property ownership (like the second home), building detailed budgets that adjust over time, comparing sorts of multiple retirement scenarios, modeling state-specific tax strategies, and printing detailed plans.

You will also have access to live classes where you can ask questions and get help. At $10 a month or $120 a year, this is an affordable way to gain more control over your future and make smarter decisions. If you are thinking about quitting or have already retired, PlannerPlus can help you feel more confident and prepared.

Do I need to link my account?

No, if you don’t want it, you don’t need to link your account to Boldin. You can manually enter everything if necessary.

Does Boldin work for a couple?

yes! It can model one or two people’s plans, making it ideal for joint planning.

Is Boldin better than Empower?

Boldin and Empower are different and they serve different purposes, so it really depends on what you need. Empower (formerly personal capital) is perfect for tracking your net worth and looking at your investments. If you’re focused on investment management and want to look at your net worth, it’s a good dashboard.

Boldin, meanwhile, focuses on the plan. It helps you consider when you retire, tax strategies, retirement spending, healthcare costs, and more. If you understand your future financial situation and want to actively plan it, Boldin is a good choice.

In fact, many people use both tools together. Empower for investment tracking and Boldin for retirement plans. That way you will get the best of both worlds.

Can I use Boldin with Financial Advisor?

Yes, many Boldin users share their plans with their advisors or use them to guide financial planning meetings.

Is Boldin easy to use?

I found the Boldin to be very easy to use. You can set it up in just a few minutes, or spend hours and actually diving in all the different features. It really depends on what you’re looking for.

Is Boldin safe to use?

Yes, Boldin is safe to use. Boldin uses bank-level encryption and follows strict data privacy standards. You can also use the platform without linking your actual bank or investment account. This means you can maintain control and enter everything manually if necessary.

Why did the new retirement change to Boldin?

The company changed its name from New Tirement to Boldin in 2025, better reflecting its mission. The new name, Boldin, comes from the idea of helping people retire and become bold. The name has been changed, but the tools are the same.

Boldin Review – Summary

I hope you enjoyed my Boldin review.

So is Boldin worth it?

Yes, if you’re preparing for retirement or already there, I think Boldin is one of the best tools out there. It will help you answer big questions and give you real peace of mind.

I think it’s great for planners like me who constantly run scenarios on their heads and spreadsheets. It’s great that everything is laid out on an easy-to-use platform that automatically generates graphs and practical tips for you.

I personally plan to maintain the subscription I started and refer to it regularly.

Boldin will help you:

- It will be more organized

- Set financial goals

- See what actions you can take to better manage your money, or retire before

- Make informed decisions

more.

If you are ready to control the future, we highly recommend checking out.

Click here to try Boldin for free.

Have you used Boldin? Do you like building retirement plans with tools like this, or do you stick to spreadsheets and financial advisors?

Note: To protect my privacy, the image in this Boldin review is not my personal finances. They were either provided by Boldin or created with another test account I created.

I recommend reading:

(TagStoTRASSLATE) Money Management (T) Resignation