Credit Karma Review

free

-

Fee

-

Credit Accuracy

-

support

summary

Check your credit score for free with Credit Karma and get recommendations on increasing your score!

Strong Points

- Free credit monitoring

- User-Friendly Interface

- Daily Credit Score

- Personalized Recommendations

- High-yield savings account

Cons

- Only 2 or 3 credit bureaus are included

- VantagesCore instead of FICO score

- Limited access to credit report

- Third-party advertisers create cluttered interfaces

Credit Karma’s services help users stay up to date with their current financial position and provide useful resources and personalized tips on improving their finances and credit scores.

Use services like the following Credit Karma It’s a great way for anyone who wants to build or maintain a good credit score.

However, you may wonder whether credit karma is the best option to improve your credit this year.

Read my credit karma reviews and continue to learn why many people rely on credit karma to monitor their credit scores and get great financial advice.

Credit Karma Review: Key Takeout

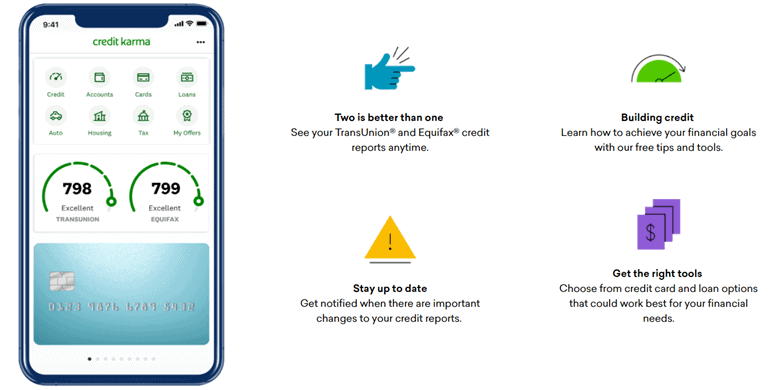

- Credit Karma provides free credit scores and credit reports with information that Equifax and Transunion provide for their scores.

- Is credit karma free? Yes, it’s really free! Is Credit Karma safe? Double, yes – that’s why we use it.

- The company has over 130 million members, helping people understand their finances and credit history.

- It provides valuable insight into factors that affect your credit score, such as your payment history, age and number of credit accounts, and credit usage.

- Set up government support and use your credit builder account to better manage your money.

- The platform uses your profile to view curated offers and provide tools to improve your finances and credit.

- Credit Karma Money Spend is a checking account option that allows users to manage their money and track their spending.

- Credit Carmamanae Save is a high-yield savings account that allows you to earn more money through your savings.

What is Credit Karma?

Credit Karma Founded in 2007, Credit Karma became the branch of INTUIT, with people helping us with our taxes!

With over 120 million members, Credit Karma helps people gain insight into their finances and credit.

The company first aimed to provide consumers with free access to credit scores and reports.

Today, Credit Karma isn’t just a stopover to offer you a score.

Credit Karma tools help consumers improve their credit reporting, including personalized recommendations for improving scores.

You’ll get both your Equifax and Transunion credit scores and what’s keeping you at bay.

You can also get alerts for important changes to your credit limits and credit ratings, as well as offers curated based on your credit profile.

Main features and financial products

these Credit Karma The feature provides the information and tools you need to make better decisions about your financial future.

And these financial products will make managing your money much easier!

Let’s take a look at some of the major credit karma features and financial products that stand out from other credit services.

Credit Tracking

One of the most important features of credit karma ability is Track your credit score Free.

This includes Equifax and Transunion scores updated every 7 days, allowing you to monitor important changes in real time.

Not only does this help you monitor your overall credit health, but it also helps you find extraordinary activities and take action quickly when needed.

You can also check factors that affect your score, such as your loan amount and payment history, to better understand how it works.

Credit Report

Credit karma also shows what is affecting your credit Detailed Credit Report From two of the three major credit bureaus, Equifax and Transunion.

One of the great things about credit karma is that it’s easy to understand credit reports.

They break down each section and explain what it means to your overall score.

Additionally, it provides useful tips for improving each aspect of the report, such as debt repayments and dispute errors.

If you have any questions, our customer service team is available.

Regular updates on your credit karma credit score will help you stay in touch more frequently.

You can receive alerts if there are changes to the report, such as new public accounts or missed payments.

This allows you to know your credits and take actions whenever you want.

Credit Score Simulator

Have you ever wondered how a particular action affects your credit score? No need to search anymore Credit Karma Credit Score Simulator.

Simulators are tools that allow you to explore different scenarios and see how they affect your score.

Whether you’re considering paying off your debt, paying off your car loan or opening a new credit card, simulators can help you make informed choices.

It is important to remember that the results provided by the simulator are estimates rather than predictions.

However, this tool can provide valuable insight into how different actions affect credit scores at different credit reporting agencies.

Credit Builder (Loan)

Are you struggling to build a credit score? There is no other program except Credit Karma’s Credit Builder.

You can apply for an interest-free loan so you can build your credit and save money at the same time.

Essentially, start with a $500 goal without a monthly fee and use your credit builder as a savings spot.

Decide how much you will be on the loan, whether it is weekly, every other week, or monthly.

When you pay for them, that money is left behind and this sets you up to gain track record of making you a better history.

Credit Karma says you can increase your score by an average of 21 points in just four days!

Credit Carmamana

Credit Karma Provide new money experience with Credit Carmana accounts.

Bank accounts have FDIC insurance up to $250,000, so users can feel secure that their money is safe even in the recession.

Your account comes with 24/7 customer support, so if you have questions about your account, you don’t have to worry about leaving your customers in the dark.

It offers two bank accounts to make the most of your money – Credit Karma Money Expenditure and Credit Karma Nae Save:

Credit Carmana Cost Account

Credit karma money is spent This is an online checking account that can be opened 100% free, with no overdraft fees or penalties.

Overdraft fees are a big game chapter for those living payroll who are worried about when the next bill will be a hit.

Plus, you can enjoy free withdrawals and you can’t worry about maintaining your lowest balance in this bank account.

With this checking account, you can enjoy free withdrawals at over 55,000 ATMs nationwide.

Additionally, if you obtain a Visa® debit card, you can earn cashback rewards for your selected debit purchases, allowing you to build low credits while saving money.

That’s an advantage for both parties!

Credit Carmamana Save – High Yield Saving (HYSA)

Credit Carmamana Save There are no competitive interest rates and monthly fees.

This allows users to easily save money without worrying about hidden fees or low return on investment.

Credit Karma’s HYSA currently offers more than 10 times the national average (4.10% vs. 0.4%).

Furthermore, there is no fee and minimum balance requirement so that anyone can use a savings account with credit card carmanaee.

Tax Software

Are you a Credit Karma member trying to file your taxes? You are lucky as Credit Karma offers tax applications Turbotax!

Turbotax is a paid service for filing taxes, but offers discounts and coupons, and some people are eligible for free submission!

you Eligible for free submissionTurbotax provides step-by-step guidance throughout the process and helps ensure that taxes are done correctly.

Additionally, with TurboTax, you can get the largest refund possible by identifying deductions and credits you may have missed.

To use this service, you must electronically inspect your federal tax return with TurboTax and hold or open a Credit Karma Money Spend account.

Using Credit Karma tax returns through Turbotax still has advantages, mainly due to great reviews from other users.

If you would like to use Credit Karma tax returns via TurboTax, please carefully check the terms before proceeding.

And don’t forget to collect all the financial documents you need in advance. That way, don’t forget that the process will go smoothly.

Loan Market

Don’t know how a personal loan works or is it suitable for you? Credit Karma Here you can help with a simple loan calculator.

Credit Karma offers Loan Market You can compare prices from the top render.

You can also apply online immediately. You can also put all the details and information you need in one place.

Credit Karma offers a variety of financial products, including personal loans, car loans, credit cards, and insurance services.

Credit Karma’s loan marketplace offers not only convenience but peace of mind when looking at many options.

This platform will help you view a variety of loan options and identify which one suits your needs.

Whether you’re looking for debt repayment calculator, credit card repayments, or financing your large purchases, Credit Karma has yours covered.

Additionally, reviews from various lenders on the site allow users to make informed decisions about which lenders they choose to suit their personal loan needs.

ID monitoring

Are you worried about identity theft? It’s easy to feel vulnerable as much of our personal information is online.

Hey, don’t worry! Credit Karma has your back with them Free Identity Monitoring Tool.

What exactly is ID monitoring? Essentially, it is a service that monitors your personal information and warns you in the event of something suspicious, such as identity theft.

You can’t check every credit card and every email every day to make sure everything is added and there’s nothing suspicious happening.

Credit Karma can track things like this for you and remove another one from your plate!

Their theft monitoring includes reviews of new accounts, new credit cards published under your name, or changes to credit reports that do not match normal activities.

Additionally, Credit Karma’s free ID monitoring alerts you if your personal information is involved in a data breaches or other security incident.

Relief Roadmap

The economic impact of the coronavirus pandemic is affecting everyone. Luckily, Credit Karma created something personalized Relief Roadmap.

This free tool is designed to provide the support you need during these challenging times.

This will help you connect with government stimulus programs, debt relief opportunities, loan options, and other useful financial tools.

The relief floor map is easy to use and is tailored to your specific needs and financial situation. This really helps families during difficult times.

Whether you’re looking for information on how to apply for government assistance or need help managing your debt, the relief roadmap is covered.

Just answer a few questions about your financial situation and Credit Karma offers a customized action plan.

Government Support – Early Access

If you are participating in a government support program and are waiting for the money to strike the bank, credit karma can help it arrive earlier.

To qualify, you must obtain funds from Social Security, VA benefits, or Supplementary Security Income (SSI).

Get a Credit Carmana Account, set up a direct deposit and link with government documents.

Once Credit Karma receives confirmation from the federal government, you can get assistance up to five days in advance.

These few days can make all the difference for many people, and it is one of the best new features.

Fee

Are you wondering about the cost of using credit karma? Well, the good news is that it’s completely free!

Yes, you read it correctly. Credit Karma does not charge you for the service. As you can see, there are plenty of features to make it completely free.

Access your credit reports and scores from Equifax and Transunion without paying Dime and receive advice that will help you with your own financial situation.

Other Credit Score Apps

other Credit Score App Other financial apps provide credit scores, budgeting, loan information, and HYSA.

Let’s take a closer look at the others Money Management App It can help you with your money, credit score, etc:

Credit Sesame

Credit Sesame Another alternative to tracking your credit score that emphasizes identity theft protection and provides tailored financial advice.

Credit Sesame offers free Experian scores, Vantage 3.0 credit scores, monthly updated, daily monitoring of your account, and real-time alerts when suspicious activity is detected.

It also includes educational resources such as blog posts and videos on budgeting and debt management, allowing users to learn more about great financial practices.

One of the major draws to Credit Sesame is identity theft insurance. This covers up to $50,000 in identity theft cases.

chime

chime If you want to get more with a high-yield savings account, this is a smart option.

Chime is a financial technology company that provides innovative solutions to help you manage your finances.

One of the most popular features is the Chime FICO Score Program. This allows you to track your credit scores for free within the Chime app.

In addition to credit building tools, Chime offers high yield savings accounts (HYSAs). 2.0% Annual Yen Yield (APY).

This means you can earn interest on your savings without worrying about monthly maintenance fees or minimum balance requirements.

Read the full details Chime review here.

Best Online Banking Alternatives

chime

There is no cost to a bank account. Chimes have a back without monthly fees, so you can build credits and more.

Start saving now

FAQ

Is Credit Karma safe?

The good news is that Credit Karma It is a legitimate and secure service to use.

There are around 130 million credit karma members, but no one will stick to it unless it is safe to use.

They use industry standard security measures to encrypt and Two-factor authentication.

They are also not just make numbers that have your credit score and history coming from two major credit bureaus!

Furthermore, they do not sell your information to third parties. Everything stays between you and your credit karma.

Is credit karma free?

The answer is yes! Credit Karma offers free scores and reports on credit history from 2/3 credit departments, Transunion and Equifax.

You can use the Credit Karma app to see your score wherever you are.

In addition to this, we also provide a variety of tools and resources to help you improve your credit score and manage your finances.

How accurate is my credit calmas score?

Is your credit karma credit score accurate? It depends on several factors, including the completeness and accuracy of the information in the report.

If there is error or missing information in the report, it can affect your score and the lender sees it is not the same. Especially if you have information about all three credit bureaus!

Each lender may use a different scoring model or have an internal scoring system.

So, your credit calmascore may be closer to what a lender sees when drawing your full credit report, but it does not guarantee that it is the same.

How does credit karma work?

Credit Karma uses two of the three major credit departments to obtain credit. These numbers come from TransUnion and Equifax.

Credit Bully tracks your debts with credit cards and loans. All of this is credit scoring.

This score also depends on how many credits you have and how much you have/unused from your credit balance.

Not only can you keep up with your credit score, you can also work on how to pay it off and increase your score using their debt repayment calculator.

How does credit karma make money?

Credit Karma makes money by partnering with financial institutions to provide users with personalized loans and credit card recommendations to their businesses.

When a user applies for a recommended product through Credit Karma, Credit Karma will commission from Credit Karma partners.

This is similar to a blog or affiliate marketing link, or an influencer’s link to an Amazon product or other neat thing.

In addition to these partnerships, Credit Karma offers paid services such as tax preparation and identity theft protection.

These services are optional for users, but can provide additional revenue to the company.

Why do different apps give me different credit scores?

If you’ve seen your credit score on multiple apps or websites, each will provide a slightly different number.

It is important to understand that there are several different types of credit scores. The FICO score is the most commonly used type in the range of 300-850.

However, there are other scoring models, such as VantagesCore and Transunion CreditVision, and choose what your credit and loan business uses.

Each scoring model calculates the score using slightly different algorithms. This means that numbers may vary depending on the model used.

Additionally, each app or website can extract information from different credit agencies (Experian, Equifax, or Transunion) that affect your score.

Are Credit Karma accounts valuable?

In my opinion, the answer is yes! If you’re looking for a free way to monitor your credit scores and reports, we recommend trying Credit Karma.

We’ve been using credit karma for years and we love the features they offer.

Easy-to-read reports from credit bureaus such as Transnion and Equifax, and credit score improvement tools have changed personal finances.

You can also consider one of them The best credit building app That’s because you can give you adjusted suggestions that will help you get a higher credit score.

My thoughts

Credit Karma It is a very convenient service for those who want to use a free credit report and consider their financial position in detail.

Some other sites charge similar services, but credit karma is free!

It provides valuable insight into current financial situation and educational resources that will help everyone understand the basics of credit scores and how to budget.

They want to help you control your money and want to make sure your money rises more than it drops.

So if you’re looking for an easy way to monitor your finances while gaining knowledge along the way, definitely give it a try on Credit Karma!